Published April 14, 2025

| | Leave A ReplyFor a “Roots & Branches” column being published just before the current Federal income tax deadline of April 15, it seems appropriate to talk about some things I’ve learned about taxes, some of which relate to their use as genealogical records.

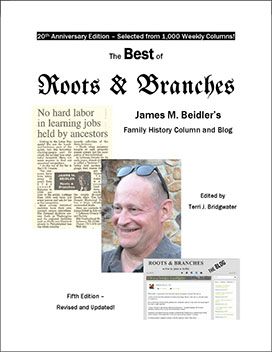

Admittedly part of my rationale for writing the column is that in addition to being a professional genealogist, I also hold the Enrolled Agent certification from the Internal Revenue Service (I may sound like I carry a gun and enforce tax laws but in actuality an EA is a credential like a CPA, only just for tax preparation and representation).

The first thing about taxes and genealogy is that most of them are public records: Many historical tax lists, which until recently were more geared toward use of land and property than income, are available online (FamilySearch.org is a great source for these).

Indeed, one of the interesting things I’ve learned over the years is that in colonial times, taxes on land were technically owed by the person getting use of the land—that is, the value of the crops or livestock—rather than necessarily the actual owner of the land. Some tax lists point this out while others are silent on that fact and it must be deduced from lining up the tax records with land purchases and sales.

Another difference in records from colonial and early Republic times is that tax collectors were essentially given an amount to collect and had discretion on which to tax to get it. Which might have been great for those people deemed too poor to tax but descendants are left with no entry for that ancestor!4

Income taxes are an exception to this since they are ordinarily covered by strict privacy laws, the strictness of which dates to the late former President Richard M. Nixon going on fishing expeditions for his supposed enemies (and are now being tested again).

What’s already an exception to this is that the Civil War era income tax is not covered by privacy acts and the surviving schedules are available from the National Archives.

Ledgers of businesses, which might be kept strictly for a concern’s internal record-keeping necessities but also could show you a bunch of taxes they collected and paid such as sales tax. Ledgers are often at historical societies and historic sites such as the Landis Valley Farm Museum, which has hundreds of them.

Which brings us around to that pesky tax deadline this Tuesday. Unless you are a corporation or partnership, which means you should have filed by March 15 (which was the old individual deadline until a few decades ago).

Or unless you get an extension, which gives you all the way until Oct.15 to file—the emphasis on that sentence is “file.” As we EAs have to occasionally remind our clients, extensions give you more time to file, not pay if you have a balance due. There are no deadlines for payment past Tuesday (although you can go on a payment plan, which adds interest and late penalties).